Right now, in a certain city outside Tokyo, 18% of new residents are foreigners. This shows the city is becoming quite international. A lot of money, especially from places like Singapore, is being invested there. In 2024, real estate investment in Japan grew by 18% compared to the previous year, reaching 740 billion yen, mainly going to promising smaller cities. The article wonders which city this is and how far this trend will spread.

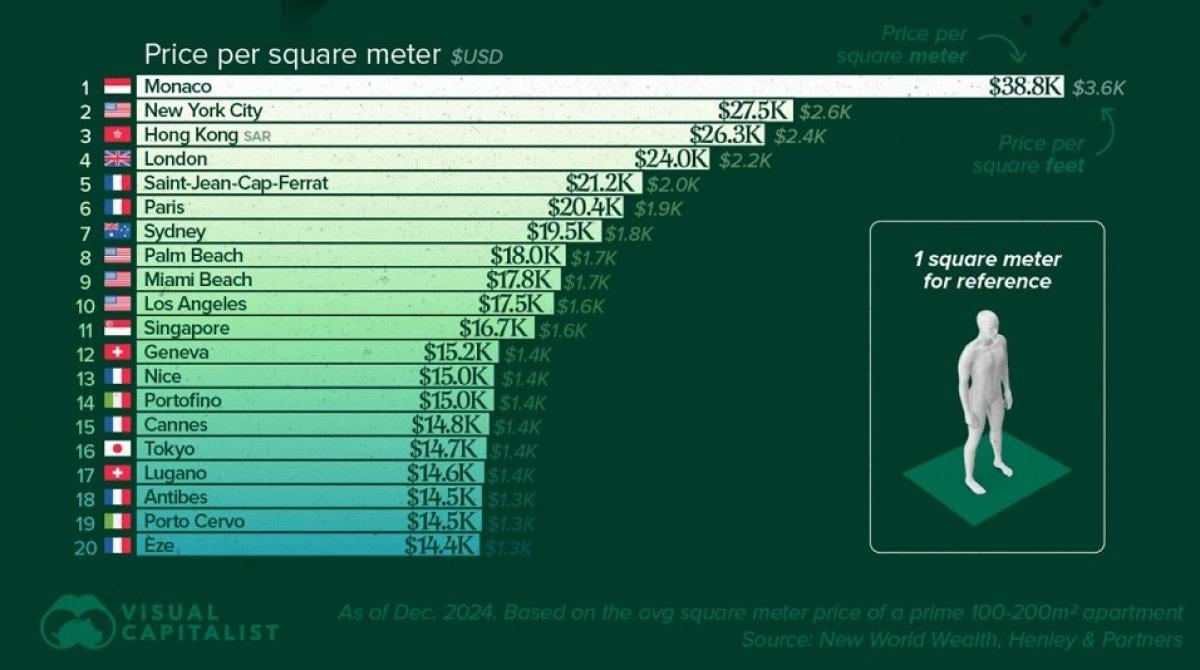

The global real estate market has Tokyo and New York as top cities. New York’s luxury market made a strong recovery post-pandemic, becoming the world’s second-largest market for ultra-luxury homes. Meanwhile, Dubai and Hong Kong also ranked high. Tokyo’s high-end real estate is growing fast, partly due to foreign investment.

Los Angeles and Osaka face different real estate challenges. LA has sky-high prices, making it hard for regular families to buy homes. Osaka’s market is growing, with prices increasing despite more homes being available.

The pandemic changed the US real estate market dramatically, shifting demand to suburban areas. Meanwhile, suburban markets in Japan are growing as people seek more space outside the city.

In the US, the Sunbelt region has seen rapid growth due to its affordable living costs. Cities like Dallas and Austin are booming. In Japan, Fukuoka is a standout city, attracting international residents and investment, with newcomers making up 18% of new residents.

Overall, Japan is seeing increased international investment, driven by stability and a weak yen, focusing on cities with high growth potential. This trend is expected to continue as Fukuoka and other cities develop further.

by MagazineKey4532