TL;DR

- People who earn between ~2 million yen and ~25 million yen will have the income tax payable on their 2025 income reduced by at least 20–30,000 yen. Accordingly, employees in that income range can expect to receive a tax refund of at least 20–30,000 yen at the end of 2025.

- From January 2026, income tax will be withheld from salary income at slightly lower rates (unless your salary is more than ~25.5 million yen/year).

- Dependents may be able to earn a little more without affecting their ability to be claimed as a dependent.

What is changing?

There are four main changes:

- The basic deduction (基礎控除) is increasing for everyone whose net income is below 23.5 million yen (corresponding to salary income of ~25.5 million yen).

- The employees' expenses deduction is increasing for employees whose salary is less than 1.9 million yen.

- The net income thresholds for the dependent deduction, spouse deduction, working student deduction, and single parent deduction will increase by 100,000 yen.

- A new income deduction is being created, targeting dependent relatives aged 19-22 whose net income is above the threshold for the regular dependent deduction.

Each of these changes is discussed in more detail below.

When is this happening?

The changes discussed in this post were part of the 2025 tax reform law passed on March 31, 2025, just before the start of the government's new fiscal year. The law was subject to an unusual number of last-minute revisions, so it has taken the NTA and other interested parties a bit of time to produce explanatory materials, etc. (If you want to go straight to the source, I recommend this PDF produced by the NTA.)

The key changes don't technically come into effect until December 1, 2025. However, the changes will retroactively apply to the entire 2025 tax year (January-December).

Because the changes apply to the entire 2025 tax year, employers must take them into account when doing year-end adjustments at the end of 2025. The NTA has only recently published draft versions of the new declarations that employees will need to submit to their employers in connection with a year-end adjustment at the end of 2025. Employers are currently in the process of implementing these new declarations, and they should start to be distributed to employees (or made available digitally) from around October.

The NTA has not prepared foreign-language versions of these new declarations yet, but based on past experience I would expect them to prepare versions in five or six languages by around November. As usual, r/JapanFinance will host a Year-End Adjustment Questions Thread at that time, linking to foreign-language versions of the declarations and discussing them in detail.

Lower rates of withholding from salary income (for employees earning less than ~25.5 million yen) will take effect from January 1, 2026.

Increased basic deduction

The basic deduction is (permanently) increasing from 480,000 yen to 580,000 yen (unless your net income is above 23.5 million yen). There are additional increases for people in certain income brackets, most of which are temporary.

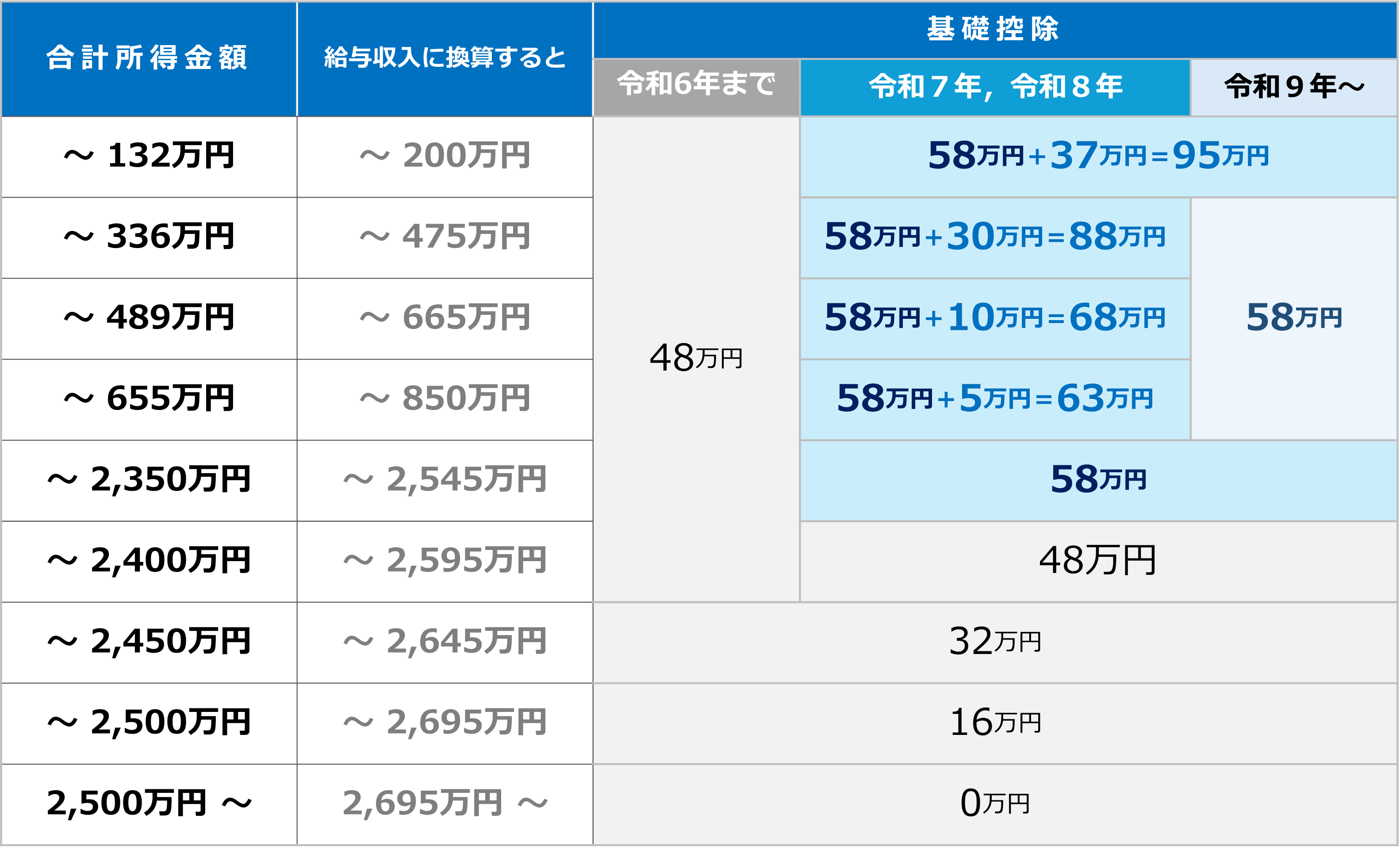

This chart does a good job of illustrating the increases. The numbers in the first column are the net income thresholds and the numbers in the second column are the salary income equivalents (the difference is due to the employees' expenses deduction).

As you can see from the chart, for people whose net income is below 1.32 million yen (salary income of ~2 million yen), the basic deduction will increase from 480,000 yen to 950,000 yen. And this increase is permanent. (Although this seems like a significant change, it's worth keeping in mind that people in this income bracket already pay very little income tax, so the actual financial benefit to taxpayers is likely to be no more than ~20,000 yen per year.)

For people whose net income is between 1.32 million yen and 6.55 million yen (salary income of between ~2 million yen and ~8.5 million yen), the basic deduction will increase by 50,000–300,000 yen depending on income, in addition to the 100,000 yen increase that everyone gets. These extra increases are temporary—they are scheduled to expire at the end of 2026.

When you consider the marginal tax rates applicable to incomes in this range, the actual value of these increases (in terms of take-home pay) will be around 20–30,000 yen per year, including both the permanent and temporary increases. When the temporary increases expire, the benefit will drop to around 5,000 yen at the bottom end of the income range and 20,000 yen per year at the higher end.

People whose net income is above 6.55 million yen (and below 23.5 million yen) will only get the permanent 100,000 yen increase, but due to the higher marginal tax rates applicable to such incomes, this increase is likely to be worth around 20–30,000 yen per year to those taxpayers (higher earners will benefit more).

It appears that the goal of the increase in the basic deduction was to put an extra 20–30,000 yen in every taxpayer's pocket (other than those whose net income is above 23.5 million yen). Though the expiration of the temporary increases at the end of 2026 looks likely to leave average income earners (3-6 million yen per year) worse off than everyone above and below them, which is surprising. Then again, it is possible that the temporary increases will be extended in a future budget.

Finally, while the permanent increase (from 480,000 yen to 580,000 yen) applies to non-residents receiving Japan-source income subject to marginal rates taxation, none of the other increases apply to non-residents. As a result, the value of the basic deduction will depend on the taxpayer's residence status, which has not previously been the case.

Increased employees' expenses deduction

The employees' expenses deduction is the amount automatically deducted from employees' gross salary to determine their net income. It exists in recognition of the incidental expenses that employees must incur in the course of their employment.

Currently, the minimum deduction is 550,000 yen, applicable to everyone whose gross salary is 1.625 million yen or less. On December 1, 2025, the minimum deduction will increase to 650,000 yen, and it will apply to everyone whose gross salary is 1.9 million yen or less.

When you combine the increased basic deduction with the increased employees' expense deduction, the effect is that it will be impossible to owe any income tax if you are an employee whose gross salary is 1.6 million yen or less (650,000 yen expenses deduction plus 950,000 yen basic deduction). Previously, this threshold was 1.03 million yen (550,000 yen expenses deduction plus 480,000 yen basic deduction).

However, it is important to note that the basic deduction for residence tax has not been increased (it is still 430,000 yen). And most importantly, the income threshold for loss of dependent status for employees' health insurance and pension purposes has not been changed (it is still 1.3 million yen). For most employees earning between 1 million and 1.6 million yen, the residence tax threshold and (especially) the social insurance dependent status threshold are much more significant financial barriers than the income tax threshold.

Increased net income thresholds for deductions

Currently, a non-spouse relative sharing the same financial household as the taxpayer must have a net income of 480,000 yen per year or less, in order for that relative to be claimed by the taxpayer as a dependent (i.e., for the taxpayer to receive the dependent deduction). In line with the permanent 100,000 yen increase in the basic deduction, the net income threshold for the dependent deduction will increase to 580,000 yen per year.

Since the net income of an employee is calculated by subtracting the employees' expenses deduction from their gross salary, and the employees' expenses deduction has been increased by up to 100,000 yen for people earning 1.9 million yen or less, the increase in the net income threshold by 100,000 yen means that dependents earning employment income will now be able to earn up to 200,000 yen more gross salary per year, while still qualifying as a dependent. In other words, the gross annual salary threshold for non-spouse dependents earning employment income has effectively moved from 1.03 million yen to 1.23 million yen.

The net income threshold for dependent spouses will also increase from 480,000 to 580,000, but due to the special dependent spouse deduction, this increase will only affect taxpayers whose net income is between 9 million yen and 10 million yen.

As with the dependent deduction, though, the increase in the employees' expenses allowance means that dependent spouses working as employees will effectively be able to earn 100,000 yen more gross salary per year before their ability to be claimed as a dependent spouse is affected.

The net income threshold for the working student deduction (claimed by employees enrolled in educational institutions who earn no more than 100,000 yen from non-employment sources) will increase from 750,000 yen to 850,000 yen. When combined with the increase in the employees' expenses allowance, this means employees eligible for the working student deduction will be able to earn 200,000 yen more gross salary per year (taking the annual threshold for someone with only employment income from 1.3 million yen to 1.5 million yen).

Finally, the net income threshold for the children of single parents (i.e., children who render their parent eligible for the single parent deduction) will increase from 480,000 yen to 580,000 yen. When combined with the increase in the employees' expenses allowance, this means employees who are the children of single parents will be able to earn 200,000 more gross salary per year (taking the annual threshold for someone with only employment income from 1.03 million yen to 1.23 million yen).

A new income deduction

The 2025 tax reform law created a new income deduction. The name of the deduction in Japanese is 特定親族特別控除. The NTA does not seem to have published anything in English about this deduction yet, so I don't know their preferred translation. For now, I will call it the "special deduction for designated relatives".

As the name suggests, this deduction is available to taxpayers who have a "designated relative". A designated relative is a dependent relative aged 19-22 whose net income is between 580,000 yen and 1.23 million yen (corresponding to a gross salary between 1.23 million yen and 1.88 million yen).

As discussed in the previous section, the net income threshold for a dependent relative (i.e., for someone to be claimed as a dependent for the purposes of the dependent deduction) will soon increase from 480,000 yen to 580,000 yen. Accordingly, if a dependent relative aged 19-22 has a net income of less than 580,000 yen, they will be able to be claimed for the purposes of the regular dependent deduction.

Currently, if a dependent's income exceeds the net income threshold for the dependent deduction (currently 480,000 yen, soon to be 580,000 yen), they cannot be claimed as a dependent. However, this new deduction applies to relatives aged 19-22 who earn too much to be claimed as a regular dependent.

The value of the deduction scales with the designated relative's net income, starting at 630,000 yen for taxpayers with designated relatives whose net income is not more than 850,000 yen, and decreasing to 30,000 yen for taxpayers with designated relatives whose net income is between 1.2 million and 1.23 million yen.

What about residence tax?

As mentioned above, the basic deduction for residence tax purposes (430,000 yen) is not affected by the 2025 tax reforms. However, the increased employees' expenses allowance will reduce the net income of employees earning less than 1.9 million yen for residence tax purposes as well as income tax purposes, meaning that the residence tax liability of such employees will be reduced by up to 10,000 yen per year.

The increased net income thresholds for dependents, spouses, working students and single parents apply for residence tax purposes as well as income tax purposes. The new special deduction for designated relatives also has a residence tax equivalent. As usual, municipalities will use taxpayers' year-end adjustments and/or income tax returns to evaluate whether taxpayers are eligible for these deductions.

Any action needed?

If you have a dependent who is affected by the increased net income thresholds, that person should be aware that the amount they can earn during 2025 has increased. And if you are a dependent who is affected by the increased net income thresholds, you should be aware that the amount you can earn during 2025 has increased.

Similarly, if you have a dependent (or are a dependent) who will be eligible for the new special deduction for designated relatives, you should be aware of the relevant net income thresholds, and be sure to claim the deduction (either on the dependents declaration that you submit to your employer around October-November or on your income tax return).

Everyone else can just sit back and enjoy paying a little less tax (unless your net income is more than 23.5 million yen per year).

by starkimpossibility

9 comments

Thanks for the write-up!

Overall fair and solid revisions I’d say.

(I just wish they could make a proper overhaul of all these deductions that cause thresholds in the first place. They just make it complicated for people, having to keep track of how much they can earn, and earning more should never have to cause you to lose money.)

Thanks for the write up.

So the permanent increase in basic deduction to ¥950,000 for people with net income below ¥1.32 million will be nice for kids with taxable (general and/or specific non-withholding) investment accounts.

Gives that extra ¥470,000 gains per year to wash to reset cost basis as much as possible.

I’m guessing if we did that though, our kids (well us, the parents) would still have to file a resident tax return for the 5% on any realized gains above the resident tax free basic deduction of ¥430,000? Or would they be not required given that the child would have no reason to file an income tax return as their taxable income does not exceed ¥950,000 basic deduction?

Awesome! Great info, thank you so much stark.

I wish they would instead just adjust all the deductions and limits (including gift tax, inheritance tax, …) for inflation, rather than doing a one-off change like that. But I guess better than nothing.

Thank you!!!

Thank you for a very informative outline of new allowances in preparation for the tax reporting season for income residency taxes. For a lot of sole proprietors over 40 years old their biggest financial outlay is health insurance 国民健康保険 Also the percentage varies between municipalities but it roughly averages out to 15% The calculation of these health insurance premiums are very different to income tax and residency tax. Do you have any pointers or links to how they are calculated and have there been any changes with the upcoming tax reporting season with the calculations.

amazing post

Apologies if this is a stupid question: will any of these changes affect sole proprietors who submit the blue tax form? Or do the new deductions only apply to employees?

Many thanks, this is gold as always.

As a reminder regarding other recent changes, the ideco limit increase will be effective from Jan 1st 2027, main change being the increase to 62 000 jpy monthly contribution to employees (whether they have DC or not). Of course this won’t impact 2025 or 2026 income taxes.

Fantastic write up. I know what all those words mean but they’ve also gone straight over my head.

This looks like something to leave to my accountant and I’ll act surprised when he tells me the government wants more money at the end of the year.

Comments are closed.