In Japan’s upcoming Upper House election on July 20, the key issue is how to support households struggling with rising prices.

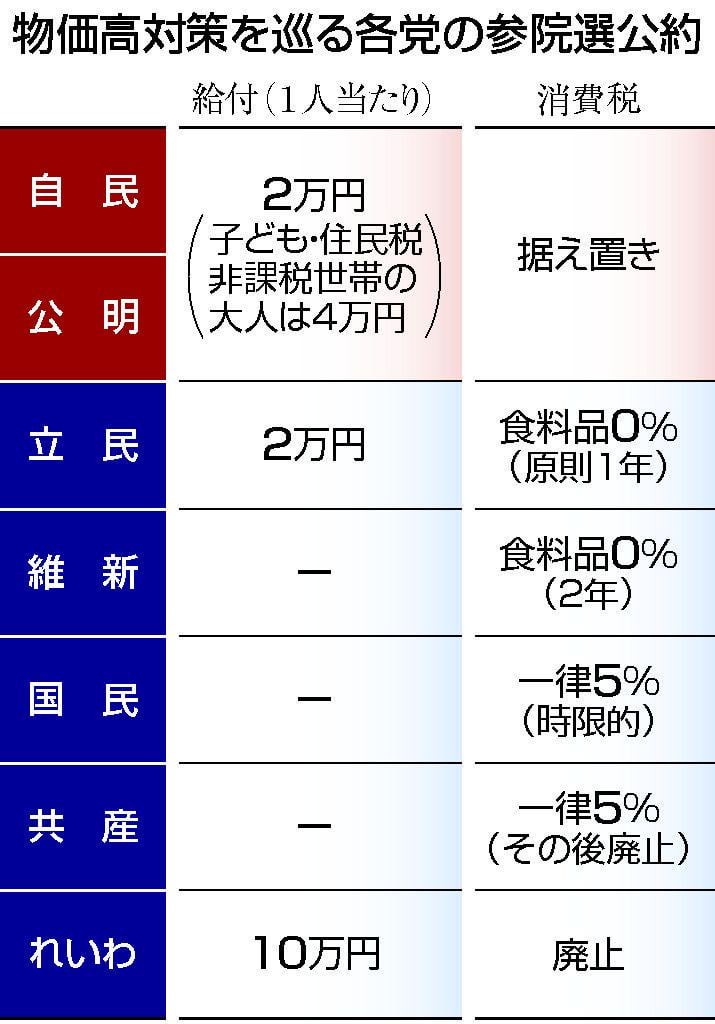

The ruling parties (LDP and Komeito) are proposing a cash handout of ¥20,000 per person, with an extra ¥20,000 for children and low-income adults. Prime Minister Shigeru Ishiba says it’s necessary because wages haven’t kept up with inflation, despite record-high pay hikes this year.

In contrast, opposition parties are calling for cuts to the consumption tax:

- Constitutional Democratic Party and Japan Innovation Party: 0% tax on food.

- Democratic Party for the People: lower the tax to 5% until real wages rise.

- Communist Party: cut it to 5% immediately, then abolish it.

- Reiwa Shinsengumi: abolish it right away.

However, the consumption tax is Japan’s most stable source of revenue (¥25 trillion/year) and funds pensions, health care, and elderly care. The ruling party argues cutting the tax would risk these services:

- A full cut to 5% could cost ¥15 trillion/year.

- The opposition says they’ll cover the gap with surpluses and funds, but critics say the funding plan is vague.

The ruling parties say they’ll fund the ¥3.5 trillion handouts from higher-than-expected tax revenues—no new debt, they claim. But economists argue that surplus revenue should go to debt reduction, especially since Japan’s debt-to-GDP ratio is over 200%, the worst among major economies.

As parties debate cash vs. tax cuts, some experts argue Japan needs a long-term growth strategy—not just short-term relief. Economist Tatsuya Kiuchi said politicians should focus on boosting productivity and economic vitality.

Expert Opinions:

- Toshihiro Nagahama (Dai-ichi Life Research Institute):

- Tax cuts are more effective than handouts, which tend to go into savings.

- A 0% tax on food would reduce revenues by ¥3 trillion but could be manageable if inflation slightly rises.

- If done, tax cuts should be permanent, not temporary.

- Kazuki Fujimoto (Japan Research Institute):

- Current proposals are too broad and not well-targeted.

- There’s little focus on fiscal discipline or what's needed for real growth.

- Once you cut the consumption tax, it's hard to raise it again.

by MagazineKey4532