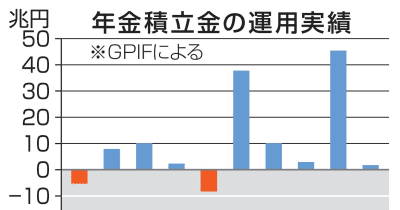

Japan’s public pension fund manager, the Government Pension Investment Fund (GPIF), announced on July 4 that it made a profit of 1.73 trillion yen (about $10.8 billion) in the 2024 fiscal year. While this is much lower than the previous year’s record profit of over 45 trillion yen, it still marks the fifth straight year of gains.

The gains came mainly from rising foreign stock prices, helped by interest rate cuts from major central banks in the US and Europe.

GPIF invests pension savings long-term to help pay retirees. In 2024, the fund earned a return of 0.71%. Since it began market operations in 2001, GPIF has earned a total of about 155.5 trillion yen. As of the end of fiscal 2024, the fund manages about 249.8 trillion yen in assets.

To reduce risk, GPIF spreads investments across four asset types. In 2024:

- Foreign stocks made a profit of 4.3 trillion yen

- Foreign bonds gained about 1.1 trillion yen

- Japanese stocks lost 820 billion yen

- Japanese bonds lost 2.8 trillion yen

By quarter, the fund had profits in April–June and October–December, but losses in July–September and January–March. The most recent quarter (Jan–Mar 2025) saw a loss of 8.8 trillion yen.

by MagazineKey4532