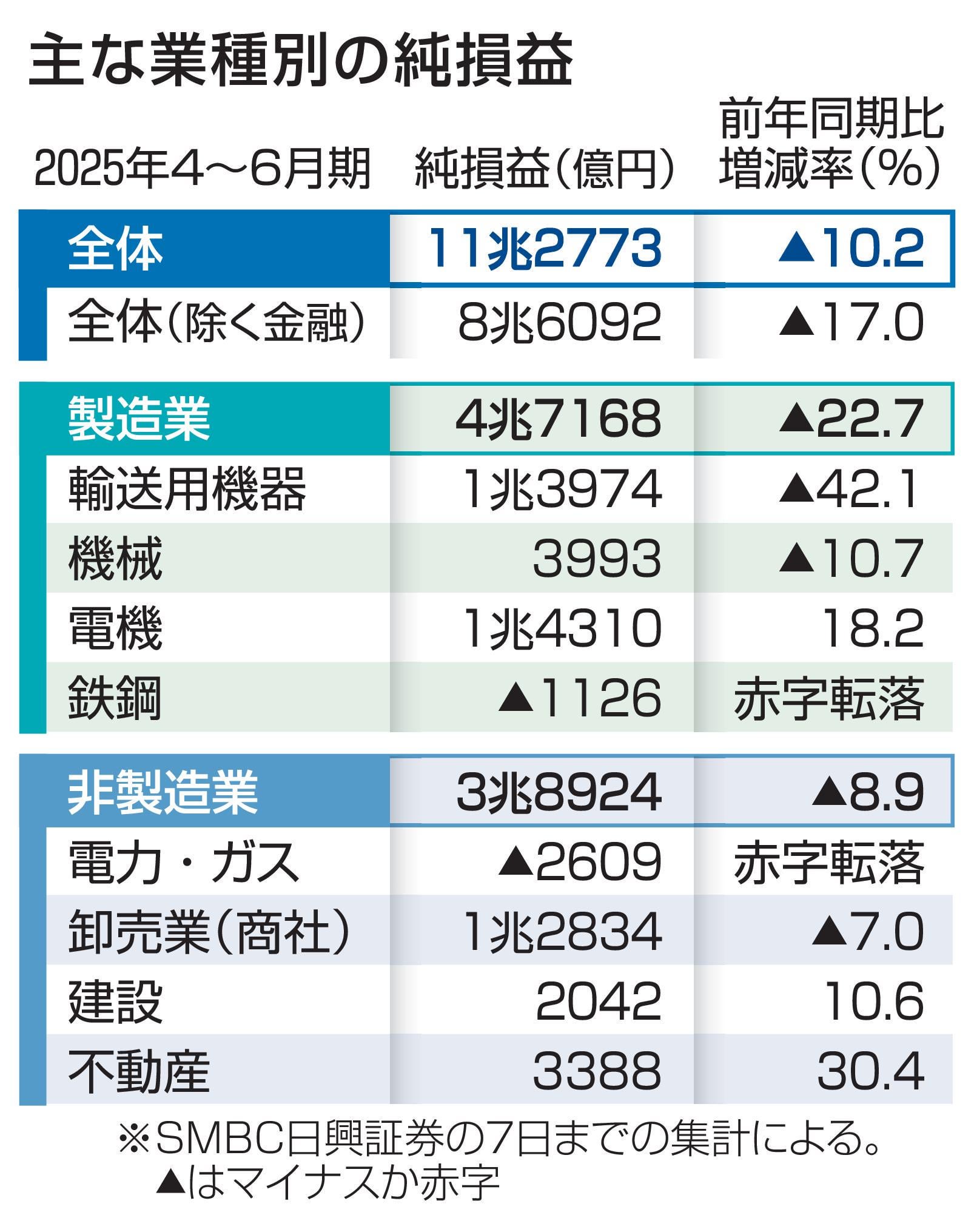

On August 8, Japan’s corporate earnings season hit its peak, with many companies listed on the Tokyo Stock Exchange reporting results for April to June. Overall, combined net profits fell 10.2% compared to the same period last year — the first decline in three years for this quarter.

Key Points:

- The main reason for the drop was the impact of US tariffs under the Trump administration, which hurt the manufacturing sector.

- Manufacturers saw profits drop 22.7%.

- Transport equipment, including cars, was hit the hardest, with profits falling 42.1%.

- Analysts now expect that total profits for the fiscal year ending in March 2026 will also decline for the first time in six years.

- The data was compiled by SMBC Nikko Securities, which analyzed 823 companies (about 70% of those with March fiscal years listed on the Prime Market).

- Chief strategist Hikaru Yasuda said the auto industry was especially affected due to weak domestic and global sales.

On the brighter side:

- Semiconductor-related companies performed well due to strong demand, especially for AI chips, helping the electronics sector rise 18.2%.

- The real estate sector also did well, with a 30.4% increase, thanks to rising sales of luxury condos in central Tokyo and higher office rents.

by MagazineKey4532

1 comment

Wow! Real estate is doing very well. Probably because foreign buyers are paying high prices for condo’s in central Tokyo? Does this mean if Japan restricts foreign real estate buyers, Japan economy would get worse?