I worked at foreign country national pavilion for Expo 2025 Osaka as specialist for communications and I was dispatched from my country for a business trip for duration of four-five months(128-130days). I have received salary to my JP bank account total for 4-5months was around 1.700.000JPY.

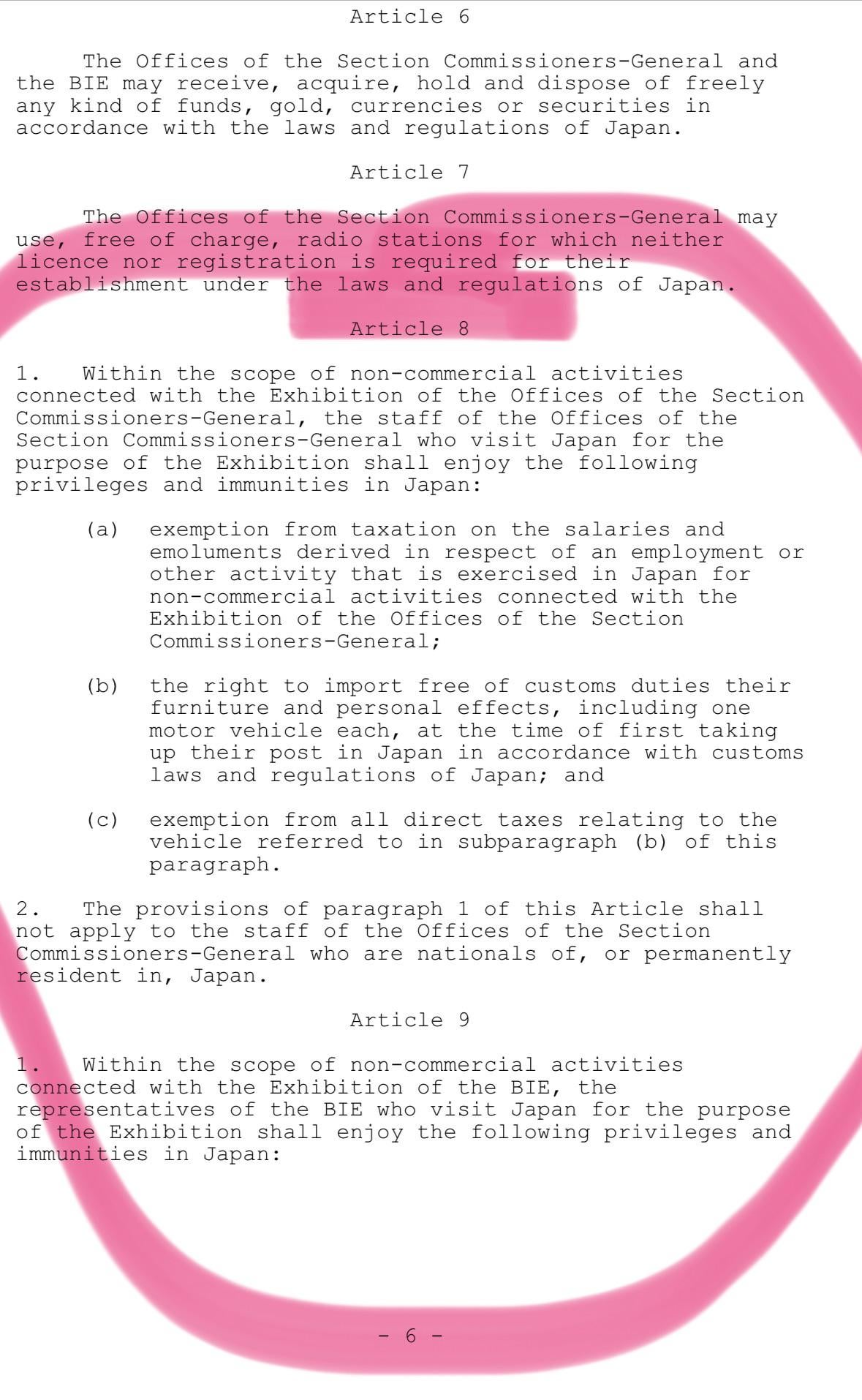

From my understanding of the BIE agreement, staff engaged in non-commercial activities related to the Expo are exempt from Japanese income tax.

Can anyone confirm if my salary during this period is indeed exempt from Japanese taxation? Also, do I need to provide any documentation or take specific steps to ensure this exemption is recognized by the Japanese tax authorities (NTA)? Has anyone here been in this situation before?

by Status-External-7453