Hello,

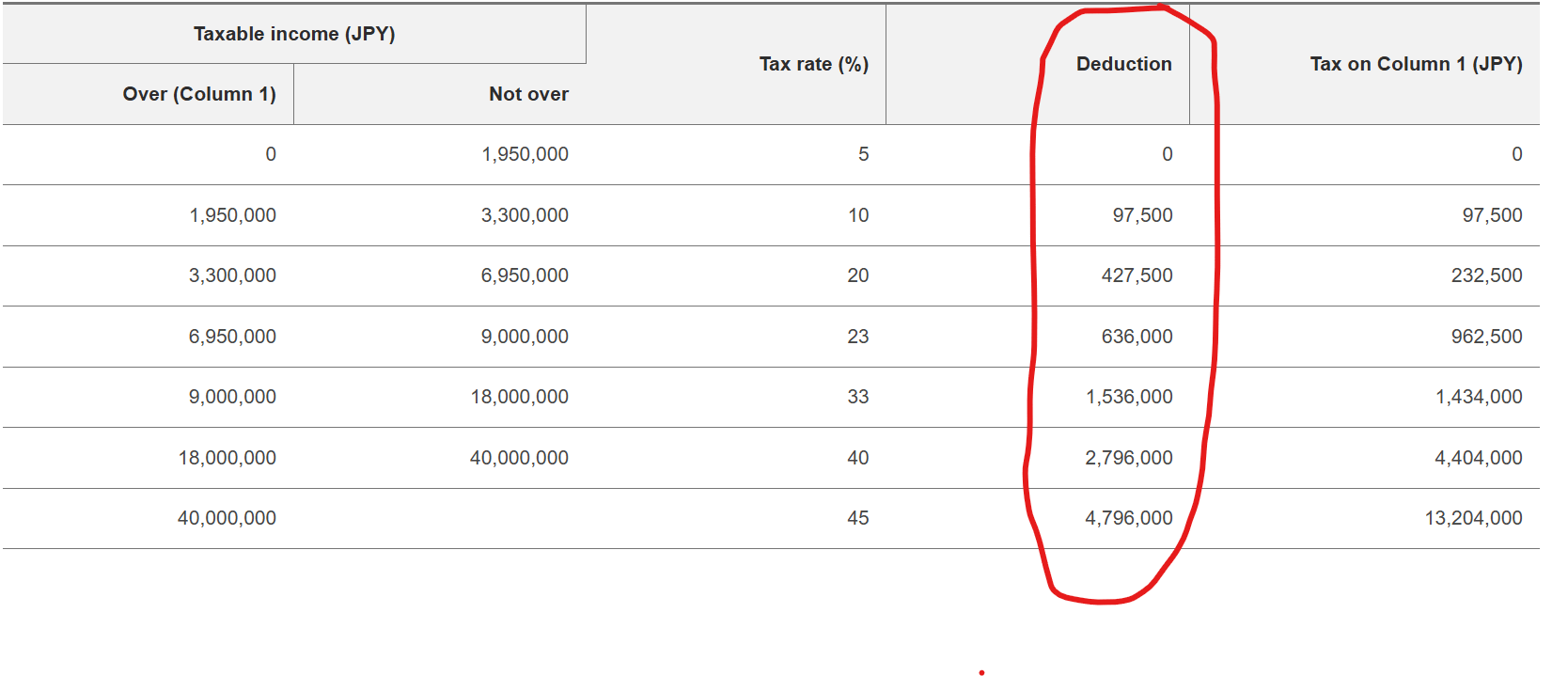

I cant seem to figure it out. I thought that perhaps any taxable amount in that range would have the respective amount deducted from it. For example, in the 10% band, the maximum taxable amount is ¥ 1,350,000@10% which is ¥ 135,000. Then from that amount, I thought that you would deduct ¥ 97,500 and that would be your tax bill. But that would only equal ¥ 37,500 which is different from the column on the furthest right which suggests the tax across that range should be ¥ 97,500.

So then I thought that you simply subtract ¥ 97,500 from the gross taxable income in that range so you will be paying 10% tax on ¥1,252,500 rather than ¥1,350,000. But that works out as ¥125,250 which is different again from the column on the far right.

please help me understand how the deductions column would take effect on an income of, say, ¥ 7,000,000 yen a year so I understand how it works across multiple tax bands.

thank you very much.

by No-Tea-592