Hi community.

I've been living in Japan for 6 years and last year I started to invest for the first time of my life. I also discovered about FIRE and I wanted to know if someone has done that in Japan that can give me some tips and some advice.

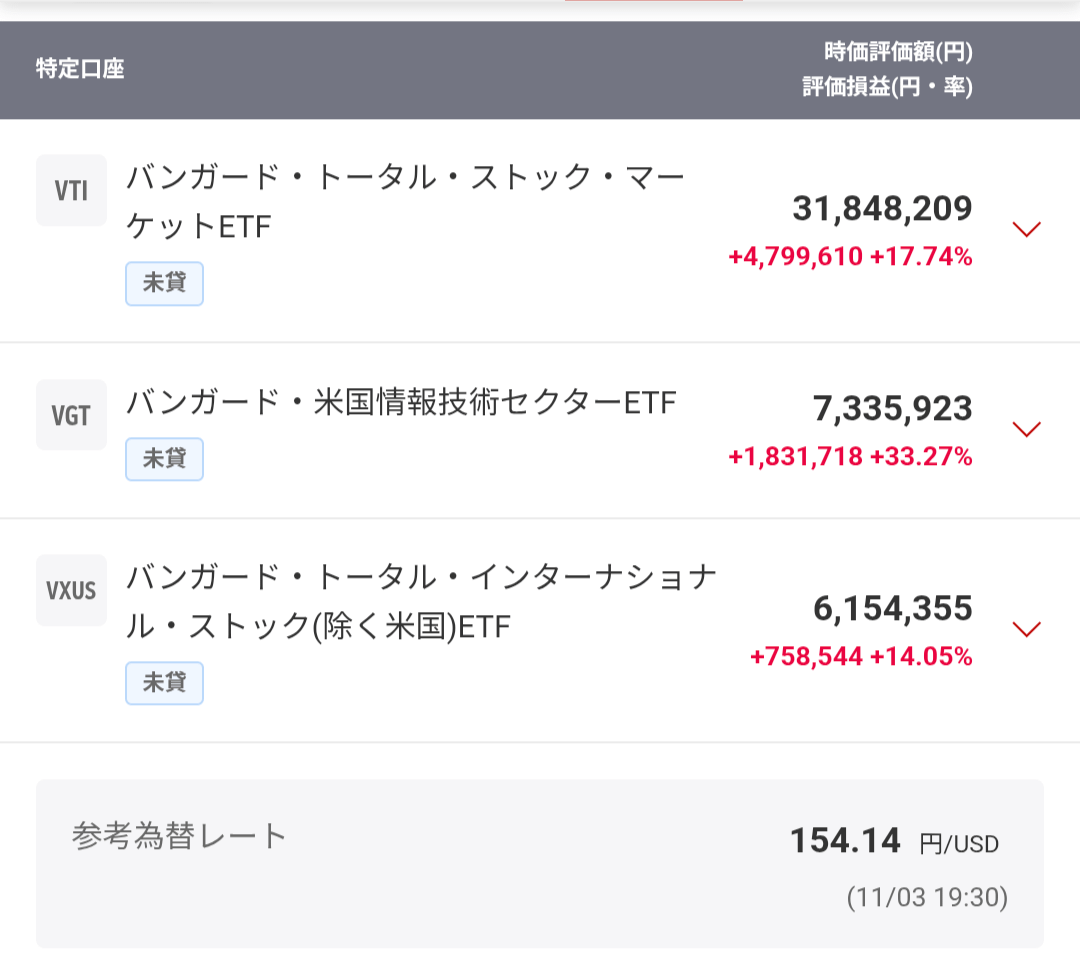

I read about the Boggleheads and I started doing VTI+VXUS (since October of 2024). In Japan I heard about ideco and I started from January of this year contributing 23k yen per month. I'm also trying to max out NISA every year.

I didn't know I was able to do monthly contributions directly to emaxis all country outside of NISA so I'm planning on doing 250k yen monthly (I have 2 months of contribution right now).

What are things I need to think about? Yes, I know everyone is different around the monthly expenses. I haven't figured that number out yet. I still don't have house but I already have PR and thinking on starting the process of getting a mortgage for a house in Tokyo.

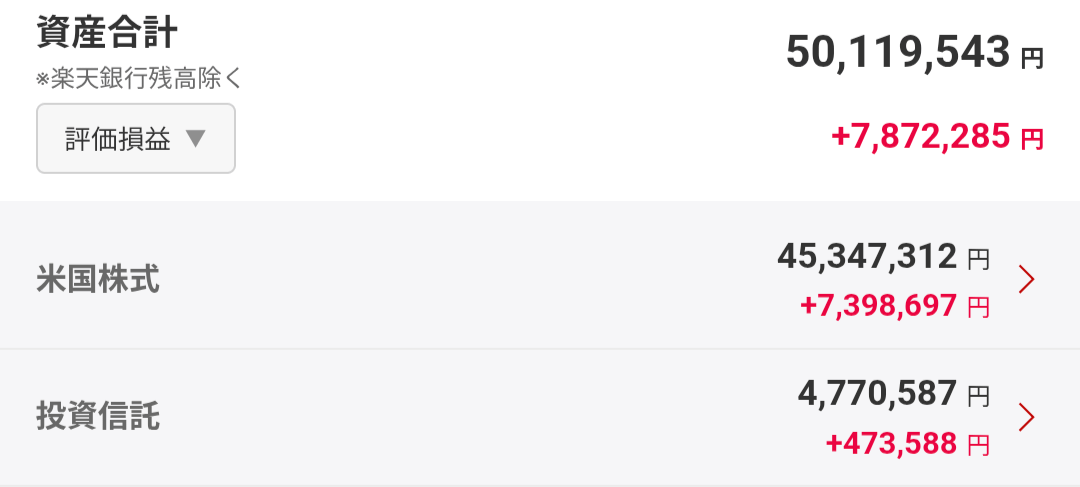

Attached is my current positions owned. I'm planning on starting selling some VGT that I bought but I want to be a boring investor and use the gains for maxing next year NISA.

Edit:

More info about me:

– Non-US taxer, 38 years old Male.

– Software Engineer with 14 years of experience, moved to Japan 6 years ago.

– 19M yearly income

– According to my mom, handsome and need to eat more.

by Which-Egg7240

15 comments

There’s no significant difference between Japan and other countries, except the mapping of tax advantaged accounts requires localization. Some people create companies to keep healthcare premiums at the corporate instead of individual rate.

I recommend get a house. A permanent one. You’ll only lose money on real estate so buy a house in a location you like. I detest apartments so I recommend a house.

Make sure you can make your mortgage payments then worry about your investments. You said you don’t have a place of your own. So I would start there first.

Congratulation, you’re already doing great. Using ideoc and Nisa, as well as emaxis slim all country, for long term investment is already quite optimized.

The biggest risk is to sell when the market is down. Market can be down for year and the psychology is difficult, especially the first time. As long as you have a healthy emergency fund and can stick to your strategy, you’re golden.

By the way are you a US Taxpayer ?

Congratulations! Keep shining in the stock market and keep making money

50 million wtf? what do you do for work

Don’t forget to use the furusato nozei to Dave more money

Besides money you should think what you would like to do after retirement. If your hobbies are hiking and farming for example, there is not much sense to get a house in Tokyo. If you want to do surfing, need good access to the seaside. If you have kids and partner – access to schools, etc, etc.

FIRE is the same here like anywhere else.

– Earn a lot, keep expenses low, or both.

– Accumulate investments until the average amount you earn annually on investments surpasses your average annual expenses.

Prioritize tax advantaged investments like corporate DC, iDeCo, and NISAs. Invest mostly into VT or VTI/VXUS. So you’re on the right track.

For some more advanced planning, factor in where you want to live long-term and start balancing currency allocations depending on where to account for currency risk. So for example if you want to retire in Japan, have some percentage in currencies in US, Global, and Japan markets with a bit more in Japan than you would have otherwise.

Another advanced planning tip, once you start factoring in multiple currencies, investing a small percentage in gold helps risk manage against currency risk and inflation concerns. A Great Depression type scenario is not the only major risk you want to risk manage, but also major inflation is another scenario you want to risk manage. So a small percentage of assets in gold (up to 5-10%) could be a consideration. For that buy IAUM, GLDM, or 1540.

Woah! Thought I was doing real well until seeing this. Well done there!!

You mom is right. Keep it up man, you are just a few years older than me but so established

Go learn about the 4% rule and why that number was chosen as the “safe” withdrawal rate.

TL;DR: It’s a monte carlo simulation that’s back tested on X years of historical SPY returns assuming you retire at age Y, with Z probability of failure (run out of money before death). I can’t remember the exact numbers but I think 4% was chosen to get 95% success rate retiring at age 65 and living until 95. So if you want to retire earlier, say at age 40, you need to adjust the formula.

If you live in Japan you can add another variable to account for currency risk but IMO it’s not a big deal, especially if you can manage to live on a 3% withdrawal rate, or even 2%.

When you do these monte carlo simulations, you’ll see why SPY (or VOO/VTI) is recommended more often than QQQ. It’s because even though QQQ has a higher CAGR, it pays for it in volatility, which will increase the duration risk of your retirement plan (higher probability of failure).

Im in the same boat with similar income and savings, but been living and investing in Japan for longer.

I’d say you’re on the right track, but I don’t do ideco because you can only withdraw from that after youre 60+ yo, so from FIRE perspective its not beneficial. NISA doesnt have such limitations.

I do S&P and all country via NISA, a little bit of gold, and about half of my portfolio is in individual stocks both in Japan and US markets.

For individual stocks though, especially Japan, you need to understand the companies, industries, macroeconomics such as government interest rate guidance, politics and do a fair amount of research, but for me Japan stocks have been really good lately.

Good luck!

To fire in Japan you need a spouse visa/status or permanent resident. With enough money, you can also go business manager but that residence status is getting more limited recently.

If you are not permanent resident, you should be eligible to apply with the point system residence status. Make sure all your taxes are in order (local taxes, pension etc…) otherwise make sure you’ll be ready asap and be careful about it from now on. Ask a specialist about it if needed.

To actually retire, either negotiate with your company or just quit. You will be eligible for unemployment benefit to some extent (you have to keep applying for jobs while you receive it, but you don’t have to accept anything).

Then that’s it. You’re retired.

I share the same goal — most people around me are also aiming for FIRE or early retirement in Japan.

A common rule of thumb is to have an investment portfolio large enough to cover about 25–30 years of annual expenses.

Personally, I spend around ¥10M a year, so my target is roughly ¥300M(or about $2M) before I’d consider myself financially independent and quit my current job (I’m a software engineer as well).

Of course, everyone’s lifestyle and comfort level are different — I know people who could easily retire with much less.

You ain’t earning 19 mil and asking Reddit for this 🤣

Comments are closed.